The 10 Best E-Commerce Fraud Prevention Tools in 2026

Piero Bassa

Founder & CEO

As online retail continues to grow toward $6.88 trillion globally in 2026, fraud is growing right alongside it. Every dollar lost to fraud now costs U.S. merchants $4.61 when you factor in chargebacks, fees, investigation time, and lost goods. That is a 37% increase since 2020.

E-commerce fraud is not just about stolen credit cards anymore. It is a complex mix of automation, social engineering, and policy abuse, often hidden behind transactions that look perfectly normal. Fraudsters create fake accounts to exploit promotions. Bots hammer checkout systems with stolen card numbers. Legitimate customers dispute valid purchases for refunds they do not deserve.

Without the right tools, these attacks erode margins, damage brand trust, and eat into the revenue your team worked hard to earn.

This guide covers the biggest challenges facing e-commerce fraud teams today and compares the 10 best fraud prevention tools for 2026, including what they offer, who they serve best, and how to evaluate them for your business.

The challenges facing e-commerce fraud teams

Fraud tactics evolve as fast as the platforms they target. Here are the biggest challenges shaping the fight against e-commerce fraud right now.

Card-not-present fraud remains the top threat

With global e-commerce transactions projected at $6.88 trillion this year, card-not-present (CNP) fraud is still the most common and costly type of online fraud. Criminals use stolen or synthetic card data to make purchases that appear legitimate, often slipping past basic rule-based systems. Global CNP fraud losses are estimated to reach $28.1 billion by end of 2026, a 40% increase from 2023.

Friendly fraud and chargeback abuse keep climbing

Not all fraud comes from criminals. Studies estimate that 62% of chargebacks stem from friendly fraud, where customers dispute valid purchases either intentionally or by mistake. Global chargeback losses are projected to exceed $33 billion in 2025 and reach $42 billion by 2028.

E-commerce teams spend significant time managing disputes, while rising chargeback ratios can threaten merchant accounts, increase processing fees, and strain customer relationships.

Account takeover attacks put trust at risk

Account takeover (ATO) attacks target stored payment credentials and loyalty programs because they deliver immediate payouts. Once attackers gain access, they drain balances, redeem points, or make unauthorized purchases. Every compromised account is not just a transaction loss but a blow to long-term customer trust.

Promotion and return abuse quietly erode margins

Fraudsters exploit referral codes, new-customer discounts, and return policies at scale. Some automate the process entirely, spinning up fake accounts to claim promotional offers repeatedly. These behaviors rarely trigger traditional fraud alerts, but they chip away at profit margins and distort marketing ROI over time.

Balancing security with checkout speed

Consumers expect instant, frictionless purchases. Any added friction risks abandoned carts and lost revenue. Overly strict rules block legitimate buyers. Overly lenient policies invite abuse. The best fraud prevention adapts dynamically, tightening controls only when risk is high.

The 10 best e-commerce fraud prevention tools

The most effective platforms combine machine learning, device intelligence, and behavioral analytics to distinguish legitimate shoppers from bad actors in milliseconds. Here are the leading tools for 2026.

1. Guardian

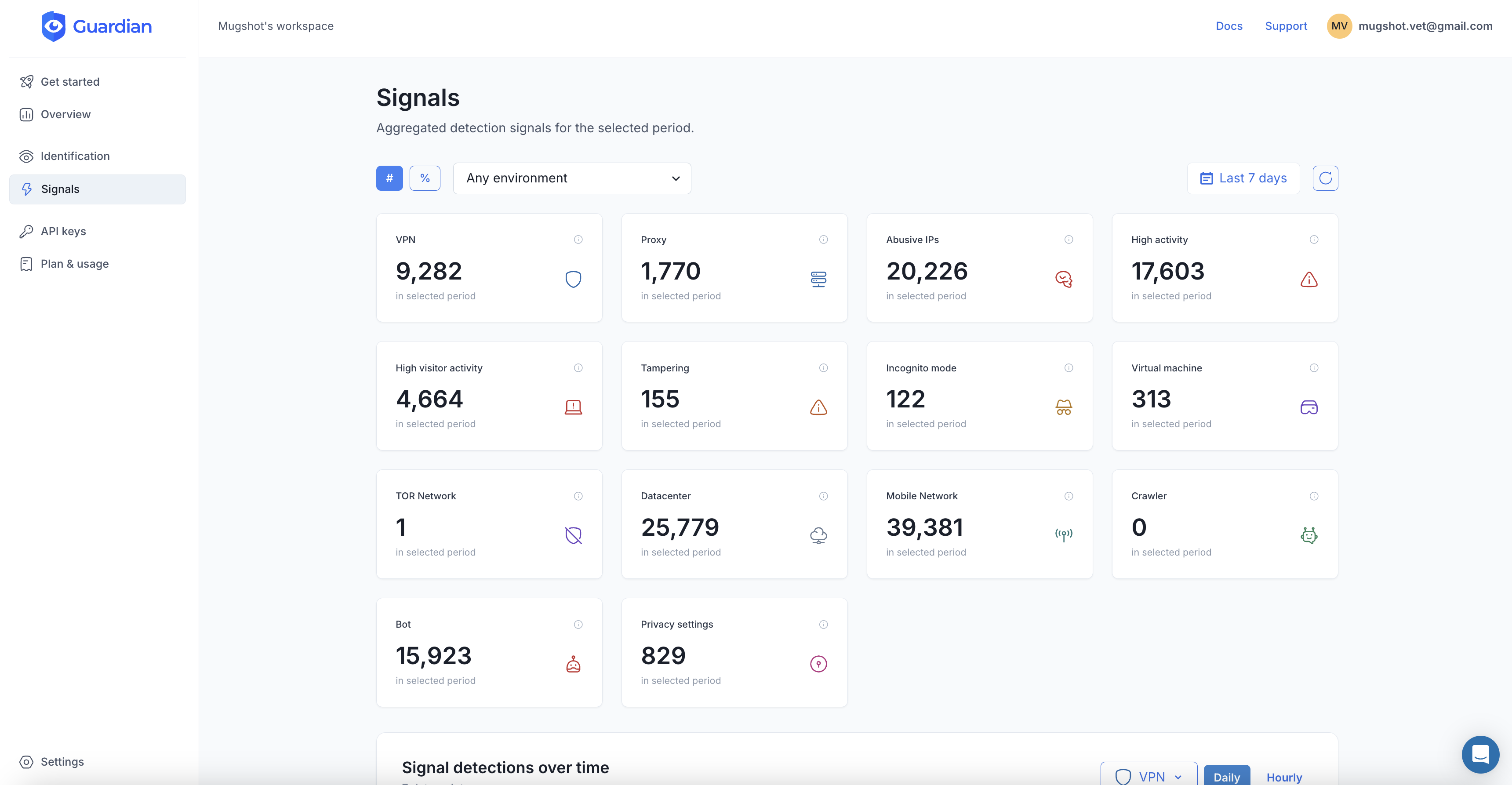

Guardian helps e-commerce merchants stop fraud while keeping checkout fast and frictionless. Built on 70+ browser, network, and device signals, its device intelligence generates a persistent visitor ID that reliably recognizes returning visitors, even when they clear cookies, switch networks, or use incognito mode.

With 99.5%+ identification accuracy and Smart Signals powered by machine learning, Guardian gives risk teams the visibility to spot suspicious behavior like tampered browsers, proxy use, VPN detection, and bot activity. This allows you to stop account takeover attacks, prevent payment fraud, and reduce chargebacks in real time, all without disrupting legitimate buyers.

What it offers:

- Persistent visitor identification that lasts months to years, linking fraud patterns across sessions

- Smart Signals for real-time detection of VPNs, bots, browser tampering, and incognito usage

- Lightweight SDKs and flexible APIs that integrate with any e-commerce stack in minutes

Pricing: Free up to 1,000 API calls per month. Paid plans start at $99 per month. Custom pricing available for enterprise.

Best for: High-volume e-commerce merchants and marketplaces that need precise visitor recognition and minimal checkout friction.

2. Signifyd

Signifyd provides chargeback-guaranteed fraud protection by reimbursing merchants for losses on approved orders that turn out to be fraudulent. Its machine learning engine analyzes order data and buyer behavior in real time across its Commerce Network, enabling merchants to approve more orders confidently.

What it offers:

- 100% financial guarantee covering fraud chargebacks on approved orders

- Large Commerce Network feeding cross-merchant intelligence into ML models

- Return abuse intelligence with SKU-level and customer-segment insights

Pricing: Outcome-based. Merchants pay approximately 1% of each approved order total. Mid-market annual plans start around $1,000 per month. Enterprise pricing is custom.

Best for: Mid-market to enterprise retailers ($10M+ GMV) wanting zero chargeback liability, especially in fashion, luxury, and omnichannel retail.

3. Riskified

Riskified specializes in chargeback-backed guarantees for large e-commerce merchants. Its AI engine learns from historical order patterns across a global merchant network to increase approval rates and block fraudulent transactions before they cost you money.

What it offers:

- 100% chargeback guarantee on approved transactions

- Dedicated policy abuse prevention for promo code, return, and reseller fraud

- Payment optimization that routes transactions and manages exemptions to increase auth rates

Pricing: Pay-per-approved-transaction starting at approximately 0.4% per transaction. No setup fees. Enterprise pricing is negotiated.

Best for: Large enterprise retailers ($100M+ GMV), particularly in fashion, travel, and ticketing verticals.

4. Kount

Now part of Equifax, Kount uses its Identity Trust Global Network and billions of historical transactions to assess risk instantly at checkout. The Kount 360 platform brings identity verification, payment fraud prevention, account protection, and AML compliance under a single API.

What it offers:

- Equifax consumer data network for richer risk scoring than standalone fraud vendors

- Unified platform covering fraud, identity, and compliance in one dashboard

- Pre-built integrations with leading payment processors and e-commerce platforms

Pricing: Custom subscription pricing based on volume and feature requirements. Contact for a quote.

Best for: Mid-market to enterprise merchants who want an all-in-one identity and fraud platform, especially those already in the Equifax ecosystem.

5. Sift

Sift’s Digital Trust and Safety platform provides modular protection across payments, accounts, content, and disputes. Its real-time machine learning console gives fraud teams transparent scoring with explainable decisions, allowing custom workflows and rules for each risk vector.

What it offers:

- Modular suite covering payment protection, account defense, content integrity, and dispute management

- Content integrity module for detecting spam, fake reviews, and scams (unique among fraud vendors)

- Explainable ML with a real-time console for building custom fraud workflows

Pricing: Starts around $500 per month for smaller plans. Mid-market typically $1,000 to $5,000 per month. Enterprise contracts average around $200,000 per year.

Best for: Digital marketplaces, platforms, and fintech companies that need fraud prevention beyond payments, including account abuse and fake content detection.

6. ClearSale

ClearSale combines automated decisioning with expert manual review for a hybrid approach that minimizes false declines. Recently acquired by Experian for $350 million, ClearSale now has access to Experian’s global identity and fraud data, significantly expanding its reach.

What it offers:

- Hybrid AI plus human analyst review that auto-approves 91%+ of orders and routes edge cases to experts

- Optional 100% chargeback reimbursement guarantee

- Deep expertise in Latin American and emerging markets where fraud patterns differ significantly

Pricing: Fixed percentage from 0.5% to 1.3% per approved transaction, or KPI-based pricing where you only pay if performance targets are met. No setup fees or long-term contracts.

Best for: Merchants selling into Latin America or high-risk geographies, and SMBs to mid-market businesses wanting managed fraud review to minimize false declines.

7. SEON

SEON provides modular, API-driven fraud prevention that combines digital footprint analysis with device fingerprinting and email/phone intelligence. It checks over 300 digital and social signals in real time to build rich user profiles. Its whitebox machine learning means fraud teams can see exactly why each decision was made.

What it offers:

- 300+ digital and social signal enrichment from email, phone, social media, IP, and device data

- Transparent, explainable ML models (no black-box scoring)

- Combined fraud prevention and AML compliance in one platform

Pricing: Free plan available (500 manual checks per month). Starter plan at EUR 599 per month with 1,000 API calls. Enterprise pricing available.

Best for: iGaming, fintech, and digital-first companies wanting developer-friendly, self-serve onboarding with a free tier.

8. NoFraud

NoFraud delivers real-time fraud screening with a hybrid AI and human analyst model. It is built for fast onboarding, with a five-minute install on Shopify and BigCommerce, and provides a full chargeback guarantee on approved orders.

What it offers:

- AI decision engine backed by live human fraud analysts for edge cases

- 100% chargeback guarantee on approved “NoFraud Pass” orders

- Plug-and-play integration with Shopify, BigCommerce, and WooCommerce with no dev work required

Pricing: Starter plans from 1.0% to 1.5% of revenue with monthly minimums starting at $250. Custom plans for merchants processing $50K+ per month.

Best for: Small to mid-market Shopify and BigCommerce merchants wanting plug-and-play fraud protection with transparent pricing.

9. Forter

Forter offers identity-based decisioning powered by an identity graph spanning 400,000+ businesses. Its recently launched Forter Prism AI copilot lets fraud analysts query transaction data in natural language, auto-generate dashboards, and get plain-English explanations for approve/decline decisions.

What it offers:

- Forter Prism AI copilot for conversational fraud investigation and insights

- Identity graph across 400K+ businesses for cross-merchant fraud detection

- Payment optimization that increases authorization rates by building trust signals with card issuers

Pricing: Custom enterprise pricing based on transaction volume. Contact for a quote.

Best for: Large enterprise merchants ($500M+ GMV) in retail, travel, and digital goods wanting fraud prevention tightly integrated with payment optimization.

10. Arkose Labs

Arkose Labs focuses on stopping automated and human-driven fraud through its newly launched Arkose Titan platform, which unifies bot detection, device intelligence, email intelligence, scraping protection, and behavioral biometrics into a single API call. Its approach centers on economic deterrence, making attacks cost more than they are worth.

What it offers:

- Unified Titan platform combining bot detection, device intelligence, and behavioral biometrics

- Sixth-generation adaptive challenges that defeat bots, AI agents, and human fraud farms

- Embedded 24/7 SOC with proactive threat hunting and tuning specific to each customer

Pricing: Custom enterprise pricing based on monthly traffic and risk thresholds. Free trial available.

Best for: Large digital platforms, gaming companies, and financial services facing sophisticated bot attacks, credential stuffing, and human fraud farms.

How to choose the right solution

Selecting a fraud prevention tool starts with understanding your risk profile and business goals. Here is what to evaluate when comparing platforms.

Detection depth and accuracy

Look for platforms that analyze multiple layers of data (device, network, behavioral, and contextual) to spot anomalies in real time. Accuracy is not just about blocking fraud. It is equally about minimizing false declines, which studies show can cost merchants more than chargebacks themselves.

Persistent identification

Advanced tools provide persistent identification that recognizes legitimate users across sessions, browsers, and devices. This is what separates modern fraud prevention from legacy rule-based systems. When you can link a visitor’s activity across months of sessions, fraud patterns become obvious that would otherwise be invisible.

Integration and flexibility

Fraud prevention should enhance existing workflows, not disrupt them. Prioritize platforms with robust APIs, SDKs, and pre-built plugins for your e-commerce platform. The faster your engineering team can integrate, the sooner you start catching fraud.

Scalability under peak load

Your solution must handle sudden spikes during flash sales, Black Friday, and product launches without sacrificing speed. Latency should be measured in milliseconds, not seconds, especially when you are processing thousands of transactions per minute.

Transparency and control

Risk teams need visibility into why a transaction was approved or declined. Solutions that provide explainable decisions, adjustable rules, and clear audit trails make it easier to fine-tune models and demonstrate compliance.

Total cost of ownership

Compare pricing models (per-transaction, revenue share, or subscription) against your transaction mix and margins. The right tool should reduce chargebacks and manual reviews enough to pay for itself through recovered revenue and operational savings.

Turning fraud prevention into a competitive advantage

E-commerce fraud is inevitable. Major losses are not. The right platform does more than block bad actors. It improves customer experience, preserves brand reputation, and turns security into a growth lever.

Guardian gives online retailers a smarter, quieter layer of defense. By combining 70+ device intelligence signals with persistent visitor identification and machine learning, it empowers fraud and risk teams to recognize returning shoppers instantly, reduce false declines, and detect suspicious behavior before it turns into loss, all without touching the checkout experience.

Start your free trial or talk to our team to see how Guardian can protect your revenue.

Frequently asked questions

What is e-commerce fraud prevention?

How much does e-commerce fraud cost merchants?

What is a chargeback guarantee?

How does device fingerprinting help prevent e-commerce fraud?

Related articles

What Is Device Fingerprinting?

Device fingerprinting identifies visitors without cookies by combining browser and hardware signals into a unique ID. Here is how it works.